One of the biggest challenges for delivering on the world’s climate change commitments is how to finance the huge costs involved. As climate-tipping points approach ever closer, there is a pressing need to embed climate change–related issues into investment and funding decision-making, both public and private. In this Viewpoint, we look at what this entails and set out some priorities for businesses, financial institutions, and government — working collaboratively — to narrow the funding gap.

THE CLIMATE CHANGE FUNDING GAP

“The era of global warming has ended; the era of global boiling has arrived.” — UN Secretary-General Antonio Guterres

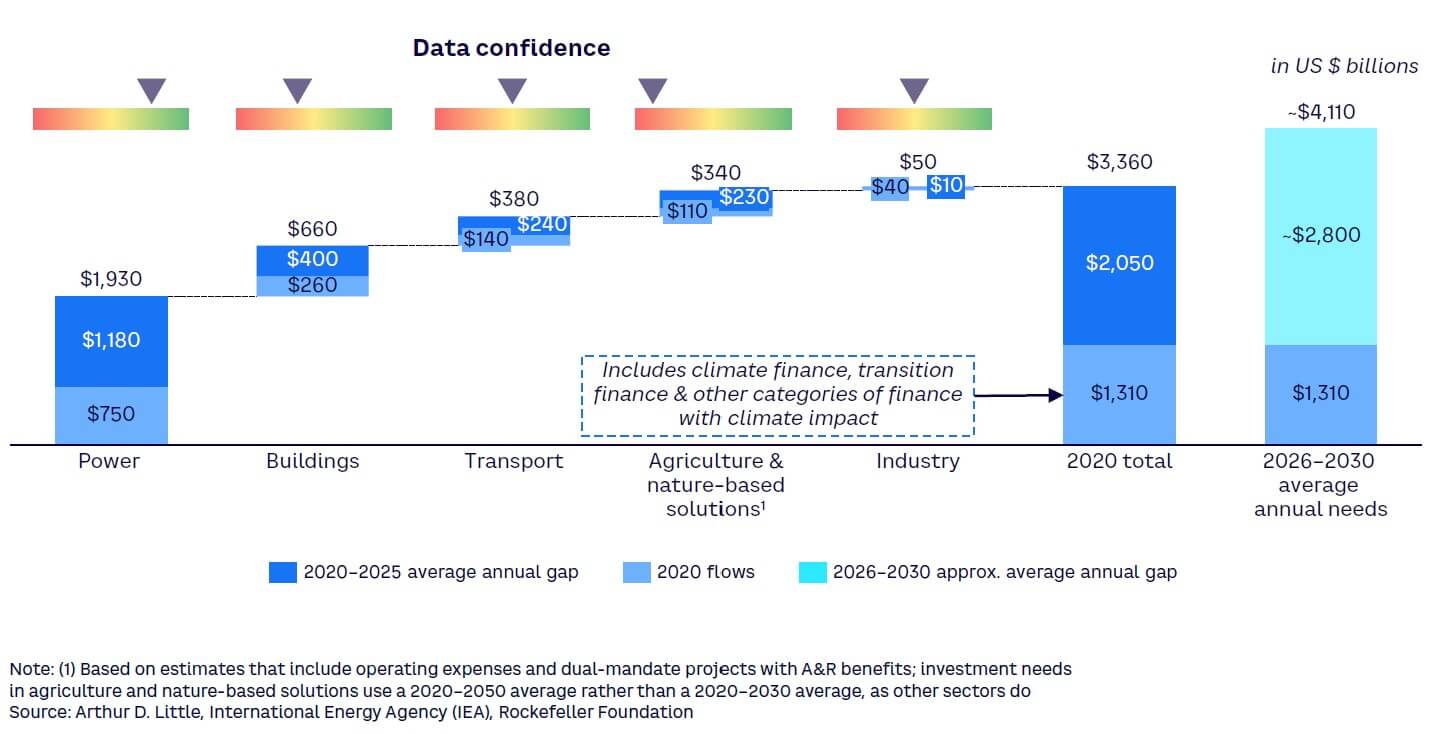

As the urgency to address climate change intensifies, one of the biggest challenges for the world is how to pay for the required mitigation and adaptation activities, such as the transition to renewable energy, new technology development, and building adaptation and resilience (A&R). A report by the Rockefeller Foundation from the 2022 United Nations Climate Change Conference (COP27) estimates that investments required to meet the United Nations Sustainable Development Goals (UN SDGs), outlined in the Paris Agreement, will be in the trillions of dollars over the next few decades. These investments have a predicted average annual funding gap of around US $2.8 trillion in the period 2026–2030 if investment flows don’t change from today’s levels (see Figure 1).

Around $3.4 trillion in mitigation finance is needed annually in the current period 2020–2025. The shortfalls extend across all sectors, although power makes up for nearly 60% of the shortfall. Developing countries in Africa and the Middle East have the largest A&R financing gap as a percentage of GDP (2.05%-2.2%) and the greatest unmet needs. Excluding China from the computation, emerging markets and developing economies will require about $1 trillion in climate finance per year, representing about a third of global need (not shown in Figure 1). According to BloombergNEF, only about 16% of climate finance needs are currently being met. Critical decarbonization levers such as carbon capture/sequestration and fuel cell technology are significantly underfunded.

With such a huge requirement, it is perhaps not surprising a shortfall in funding exists. However, various factors are contributing to its scale, which need to be addressed if the gap is to be narrowed:

-

Economic barriers. Compared to other non-green investment projects, many sustainability projects deliver low or uncertain returns. This is typically associated with long payback periods and/or high risks and uncertainties (e.g., due to technological limitations, unclear or undeveloped business models and markets, and regulatory risks such as changes in subsidies and future performance obligations). These barriers are especially applicable for private sector investment.

-

Operational barriers. Even when funds are available, operational challenges like bureaucratic hurdles, lack of local expertise, or inadequate infrastructural readiness can impede the execution of climate projects.

-

Standards barriers. The absence of universal and standardized metrics for green investment and accounting leads to disparities in how funds are allocated and difficulties in establishing the business case. Without clear metrics, there is a continued risk that funds might not be directed toward the most effective or needed climate initiatives.

-

Allocation barriers. While substantial sums are directed toward climate finance globally, a large portion of these funds is not necessarily reaching the most vulnerable regions or sectors. Developing nations, in particular, face challenges in accessing the capital needed to drive their sustainable transitions.

In the remainder of this Viewpoint, we examine how financial institutions and businesses, with the support of governments, can improve how they go about addressing climate change financing to start overcoming some of the barriers and, eventually, narrow the funding gap.

WHAT EMBEDDING CLIMATE FINANCING MEANS

Embedding climate financing into business and commerce refers to the integration of climate change–related issues into investment and funding decision-making, both public and private. Embedding climate financing aims to ensure that low-carbon and climate-resilient pathways are better financed, that investments are diverted away from fossil fuel–intensive sectors, and that business models align better with the goals of the Paris Agreement. Looking holistically at the types of activities into which climate financing needs to be embedded, we can identify four broad areas:

-

Technology and R&D. There is a critical need for technological development and innovation across a vast range of potential applications relevant to climate change mitigation and adaptation. This includes activities along the entire innovation cycle from research and early-stage concept development to scale-up, adoption, and performance improvement. In addition to financing technology and R&D, as we discuss below, financial institutions themselves can conduct R&D to come up with innovative financial products that foster sustainable growth and address the growing demand for green financing.

-

Green transition. Financially supporting industries in their transition to becoming green(er) is vital for a sustainable future (e.g., the automotive transition to electric vehicles). Transitioning is ultimately the biggest cost for industries to achieve net zero. While withholding capital from poor-performing “brown” industries can, in some cases, act as a lever to improve sustainability performance, financially supporting them in their transition, with suitable conditions attached, is essential for accelerated progress. This also allows financial institutions to discharge their obligations to contribute actively to sustainability improvements.

-

Resilience building. As well as mitigation, adaptation efforts also need financing. This includes investing to safeguard against physical risks, such as in infrastructure that can withstand the impacts of climate change (e.g., flood barriers, drought-resistant crops); securing raw materials sourcing (e.g., adapting supply chains, alternative materials); and investing in business models and manufacturing processes that are suitable for the future and robust enough to transition risks (e.g., climate regulations that disrupt “business as usual”).

-

Policy advocacy. Financial support should also be provided for policy-advocacy initiatives that promote favorable regulations and incentives for green businesses and projects. Joining coalitions like the Net-Zero Banking Alliance and committing to sustainability frameworks such as the UN Principles for Responsible Banking can signal that financial institutions are ready to (financially) support climate regulations.

WHERE CLIMATE FINANCING IS MOST NEEDED

While there are financing requirements across the whole range of climate change mitigation and adaptation activities, some of the greatest needs and opportunities are in the following areas:

-

Transition to renewable energy. The switch from fossil fuels to renewable sources like solar, wind, and hydro offers significant investment prospects. According to Statista, the global investment in renewable energy reached around $495 billion in 2022, representing a 17% increase from the previous year. Global giants like Google have made pledges to rely purely on carbon-free energy by 2030.

-

Green infrastructure. Sustainable urban planning, green transportation, and energy-efficient buildings present much-needed investment opportunities. According to a study by the European Commission, more than 35% of the EU’s total waste generation stems from the construction sector, highlighting the large room for improvement in this sector.

-

Carbon capture, usage, and storage (CCUS). Technologies that absorb and store emitted CO2 can bridge the gap between current emission levels and net zero targets. Although CCUS has been under development for decades, poor economics have greatly hindered adoption. However, net zero targets and the realization that CCUS may be the only solution for certain industries (e.g., steel and cement) have provided a new impetus. For example, the Chinese Sinopec Group has invested significantly in this area. According to the company, its Qilu-Shengli Oilfield CCUS project, which aims to capture, purify, and reuse CO2 in production processes, is expected to reduce annual CO2 emissions by 1 million tons.

-

Sustainable agriculture. According to the Food and Agriculture Organization of the United Nations (FAO), by 2050 a 60% increase in food production will be required to sustain the growing global population. Sustainable farming practices, which both mitigate and are resilient to climate change, offer substantial investment avenues. AlphaMundi Group, for example, introduced an impact debt fund (SocialAlpha investment fund) that offers credit tailored to the harvesting season of fair trade–certified fruits. The fund allows farmers to be paid in real time (rather than after harvest) and aims to encourage sustainable practices like the protection of biodiversity.

-

Sustainable packaging. The global sustainable packaging market is worth around $380 billion today and is expected to grow at more than 5% CAGR in the coming years. Major online retailers are transitioning to sustainable packaging, reducing waste, and promoting recycling. Amazon’s Frustration Free Packaging initiative is one such example.

-

Sustainable sourcing, supply chain, circularity. Managing sustainability along the supply chain from source to end of life is a major challenge, especially for sectors such as chemicals and manufacturing. Investment in digital technologies, such as the Internet of Things, artificial intelligence, simulation, and data analytics, will be a key part of the solution. Similarly, consumer brands are sourcing sustainable materials, promoting circular fashion, and using technologies to reduce water consumption. For example, companies like Patagonia are pioneering recycled polyester clothing, emphasizing repair over replacement.

MANAGING & MITIGATING THE CHALLENGES

What businesses can do

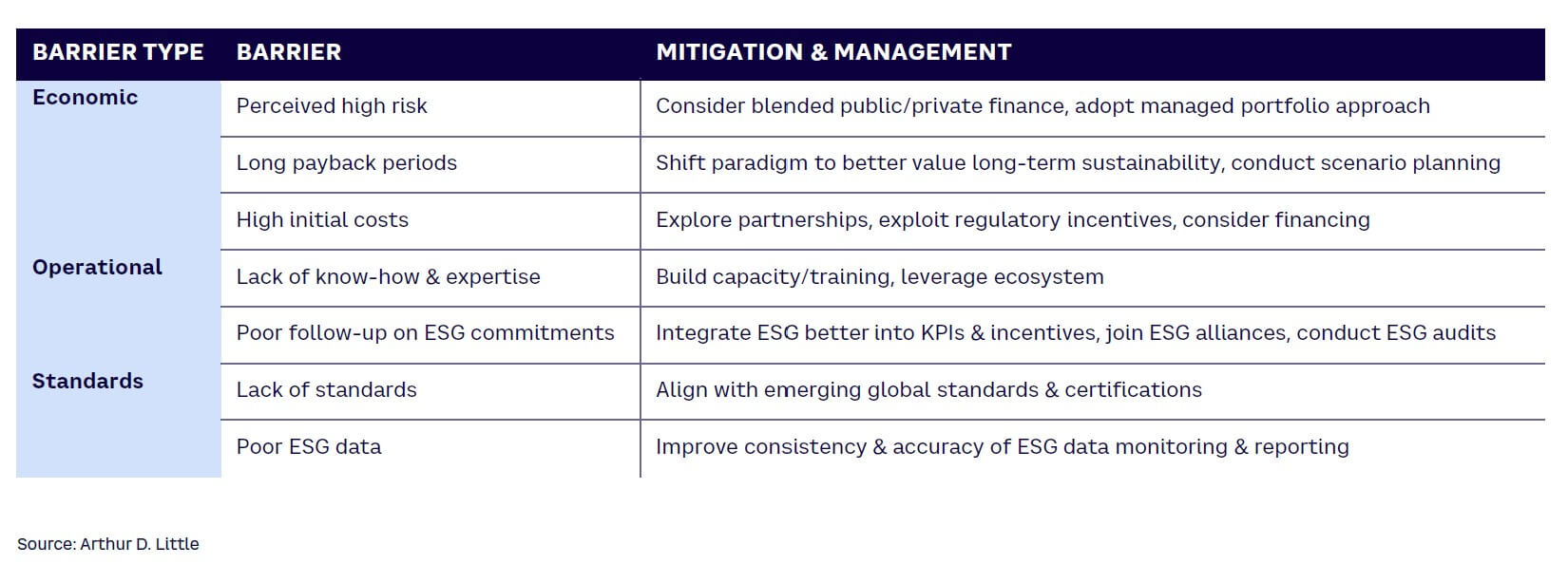

To overcome the funding gap, businesses need to do more to embed climate change issues into investment and funding decision-making, taking into account the range of challenges and barriers (see Table 1).

Economic barriers may be the hardest to overcome, especially for smaller businesses. The higher risks and uncertainties of many green investments may sometimes require blended sources of finance to offset risks. Adopting a managed portfolio approach can help ensure that higher-risk/higher-return projects are financed alongside lower-risk projects. Scenario planning can also be valuable in identifying “no regret” green investments, “strategic insurances” (i.e., investments to mitigate possible future high-adverse-impact events), and the costs of “do nothing.” Partnerships and ecosystem development are valuable for risk and reward sharing. Small businesses can also be encouraged to take advantage of the volume discounts and shared costs found in cooperative purchasing and bulk buying.

For example, small-scale wind energy producers in Denmark often form cooperatives to share the high initial costs and risks associated with wind turbine installations, demonstrating the power of collaborative investment. Finally, many sustainable technology suppliers offer financing or leasing options, allowing small businesses to access the necessary equipment without bearing the full up-front costs.

Many businesses need to address operational barriers preventing environmental, social, and governance (ESG) commitments from being realized in practice (e.g., through training, capacity building, and integrating ESG fully into corporate and personal KPIs and incentives). To address the problem of lack of standardization, businesses can proactively align with, and in some cases, influence emerging global standards and certifications. The availability of reliable ESG data is an important prerequisite to being able to properly assess business cases for ESG investment. Overall, new financial tools, strategies, and structures must be designed with a net zero target in mind, including better reporting on brown financing (i.e., financing of carbon-intensive activities).

Role of financial institutions

Banks and other financial institutions have an important role to play in working with businesses and governments to overcome the funding gap. The two key success factors here are to embrace innovation and to engage more collaboratively with business customers. The following are particularly important:

-

Develop innovative green financial products. Targeted products such as green bonds and sustainable loans, earmarked to fund environmentally friendly projects or to meet ESG criteria, facilitate the flow of capital toward sustainability initiatives. They also provide investors with the assurance that their investments will only go toward specified (climate-related) activities. Sustainability-linked loans allow borrowers to use the proceeds for general business activities, but the terms of the loan are linked to sustainability performance. Investment management companies can create ESG funds, mutual funds, or exchange-traded funds focused on ESG-compliant companies. Climate-focused venture capital — investing in start-ups with innovative solutions to climate change — is also gaining traction. Beyond Meat’s plant-based protein or Carbon Engineering’s Direct Air Capture technology are two of many examples.

-

Integrate climate into due diligence and risk assessment. ESG factors can be incorporated into credit-rating models to better recognize that companies with robust ESG practices should have better long-term risk profiles. ESG screening is increasingly being integrated into due diligence before making investment decisions or providing loans to identify potential risks and opportunities. This process can include both positive screens to identify sustainability leaders that receive capital at more favorable terms as well as negative screens to identify “bad actors” that are excluded from financing or only receive capital at more unfavorable terms. The use of big data analytics can help assess the ESG performance of potential investment opportunities, providing a clearer picture of their true long-term value.

-

Offer capacity-building and advisory services, including technology and data analytics. Financial service providers can help improve their risk exposures and likely returns by offering training, workshops, and advice on ESG best practices to their business customers, especially small and medium enterprises (SMEs). Consulting services can include, for example, how to develop and implement effective ESG strategies and/or how to transition toward more sustainable business models. Data is a critical enabler for companies to manage ESG. Financial institutions can advise clients on data management, and create digital platforms where SMEs can access resources, tools, and funding options to aid their ESG journey. These platforms can also allow SMEs to better aggregate ESG information, understand their clients’ ESG performance, and identify learnings to help them improve.

-

Develop collaborative partnerships on green finance. Collaborations with governments and public sector agencies on cofinancing green projects (e.g., public-private sector partnerships [PPPs)] can help achieve greater scale and impact as well as sharing risks and improving returns, leveraging the strengths of both parties. Collaborations with nongovernmental organizations (NGOs) and think tanks can also be valuable as these organizations often possess deep insights into local environmental and social challenges and can provide valuable expertise and guidance. For example, the asset management division of the European bank Erste Group works with the NGO World Wildlife Fund to identify green companies for some of its investment funds’ portfolio firms. Such partnerships can also help improve credibility and mitigate greenwashing concerns. Creating and/or participating in climate finance markets, specifically tailored for green financial products, is also an effective strategy.

-

Develop specialized financing for SMEs. SMEs face the biggest financing challenges for making the green transition. Financial institutions play a huge role for SMEs, including offering microfinancing loans to help them invest in sustainable infrastructures and technologies, and collaborating with international bodies, governments, or NGOs to connect small businesses with grants or subsidies designed for sustainable initiatives. Green loans for SMEs often include lower interest rates, extended repayment periods, and reduced collateral requirements. For example, the European Investment Bank provides green loans to small businesses for projects that have a positive impact on the environment, offering favorable terms and expert technical support. Crowdfunding platforms dedicated to sustainability projects are also increasing, building on the growing community of impact investors who seek both financial returns and positive social and environmental impacts. For example, StartSomeGood is a crowdfunding platform exclusively for social change initiatives, where small businesses with environmental projects can raise funds from like-minded individuals and investors.

-

Promote transparency and reporting. Financial institutions need to adopt and promote a standardized ESG reporting mechanism, like the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations, making it easier for businesses to report and for stakeholders to interpret. Better terms or rates can be offered to companies that regularly and transparently report their ESG performances, promoting a culture of openness.

-

Change internal policy and culture. Financial institutions also need to embed sustainability into their own policies, practices, and culture. This means, for example, developing a comprehensive ESG strategy that integrates ESG into everyday decision-making and providing in-house training, education, and capability building. Aligning compensation with ESG goals is a key aspect, ensuring that compensation structures, especially for top management, reflect the institution’s ESG priorities. Climate risks also need to be embedded into lending and investment assessments, accounting for both physical risks (e.g., extreme weather events) and transition risks (e.g., changing regulatory landscapes).

Role of governments

By working collaboratively with both businesses and investors, governments and international organizations can help overcome climate-funding challenges. With a focus on supporting business, especially SMEs, governments can offer:

-

Direct grant and subsidy programs. An example is the US Small Business Innovation Research program, which offers grants to businesses engaged in the R&D of environmentally friendly technologies. Another example is in India, where the government partnered with private companies under the Jawaharlal Nehru National Solar Mission to significantly increase the country’s solar power capacity, providing subsidies and incentives for private investment.

-

Tax incentives. These include credits, deductions, or exemptions for investments in sustainable technologies and practices. For example, the US federal government offers a business energy investment tax credit that allows businesses to claim a credit of up to 30% of expenditures on solar energy installations.

-

Technical assistance and capacity building. For example, the UK’s Carbon Trust provides small businesses with free energy audits, advice on low-carbon technologies, and support in developing a comprehensive energy-saving strategy.

-

Innovation competitions and awards. For example, the H&M Foundation’s Global Change Award supports early-stage innovations that present new circular approaches for the fashion industry, providing both grant funding and a one-year innovation accelerator.

-

Risk-guarantee programs. For example, the World Bank’s partial credit guarantee is an instrument designed to encourage lending to small businesses by taking on a portion of the lenders’ risk, making it easier for these businesses to secure loans for sustainability projects.

-

PPPs. As mentioned earlier, collaborations like PPPs can help achieve greater scale and impact as well as sharing risks and improving returns, leveraging the strengths of both parties.

-

International programs and cooperations. Adopting a global perspective is vital. Governments play a key role in addressing some of the global and regional imbalances that are apparent today, especially in seeking to rebalance the allocation of resources toward those countries and regions that are most in need.

Conclusion

PUTTING CLIMATE FIRST

As the ramifications of climate change grow increasingly clear, so does the importance of climate financing in guiding the world toward a sustainable net zero future. The climate funding gap is one of the biggest barriers to achieving this goal. The concept of the triple bottom line — planet, people, and profit — has been with us for decades but has still not been properly integrated. Narrowing the climate funding gap will require close collaboration between governments, financial institutions, and businesses, aimed at embedding climate considerations into every financial decision, investment, and strategy:

-

Businesses must take positive steps to overcome the economic, operational, and standards-related barriers toward embedding climate finance.

-

Financial institutions play a key role in embracing innovation in their products and services and engaging more collaboratively with business customers.

-

Governments must make the most of the range of policy and regulatory instruments at their disposal, encouraging and enabling as well as enforcing.

-

By addressing the challenges head-on, and in close collaboration, we have the ability finally to steer our planet toward a more sustainable trajectory.